Denied Insurance Claim Lawyer: Baltimore’s Inner Harbor | 21202

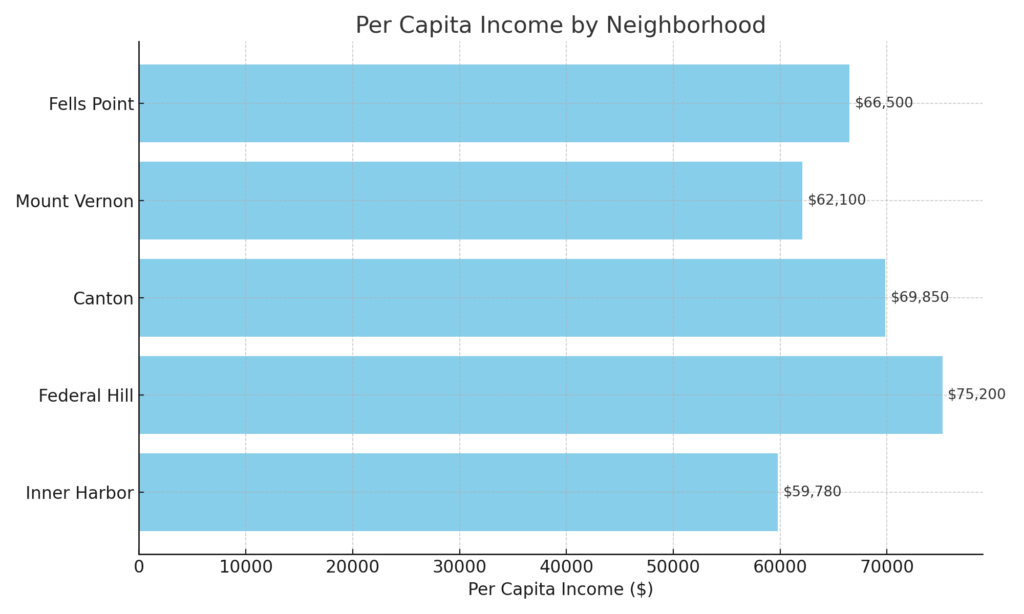

Facing a denied insurance claim can be distressing, especially when your home or property has sustained serious damage. Residents of Baltimore’s Inner Harbor neighborhood (ZIP 21202) often encounter complex challenges when dealing with insurance companies. As a Denied Insurance Claim Lawyer serving Baltimore’s Inner Harbor, and 21202, Eric T. Kirk has spent 30 years battling insurance companies to secure fair compensation for clients. Whether your claim has been denied due to alleged policy exclusions, late filing, or accusations of misrepresentation, understanding your rights is crucial. The Inner Harbor, known for its scenic waterfront, historic landmarks, and vibrant urban living, also presents unique insurance challenges—ranging from storm-related water damage claims due to its proximity to Chesapeake Bay to claims arising from older buildings with historical significance. Eric T. Kirk leverages extensive experience and local knowledge to confront unjust insurance denials and deliver results for Inner Harbor residents facing these daunting situations.

Where is Inner Harbor in Baltimore?

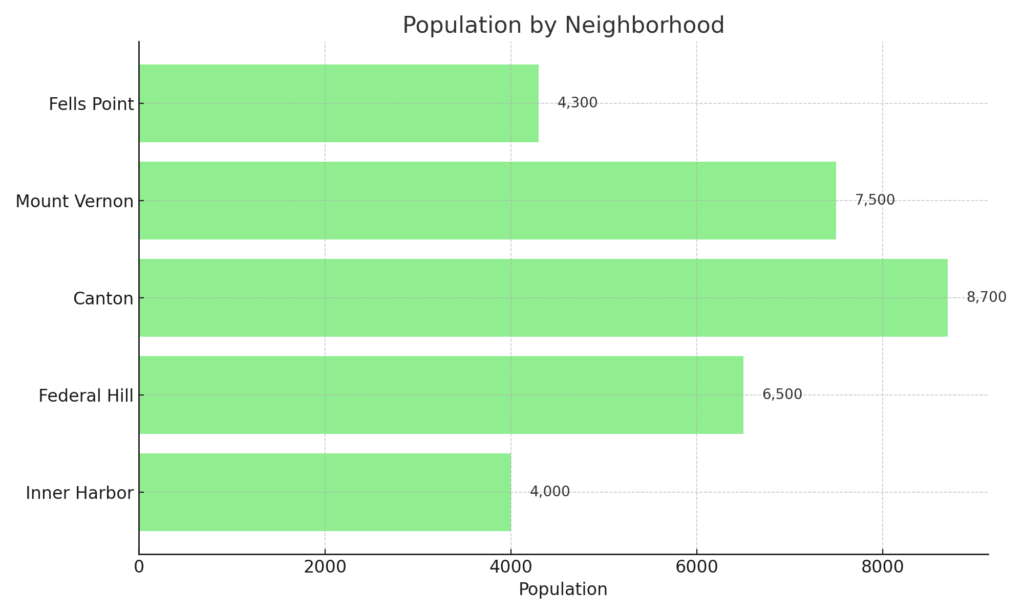

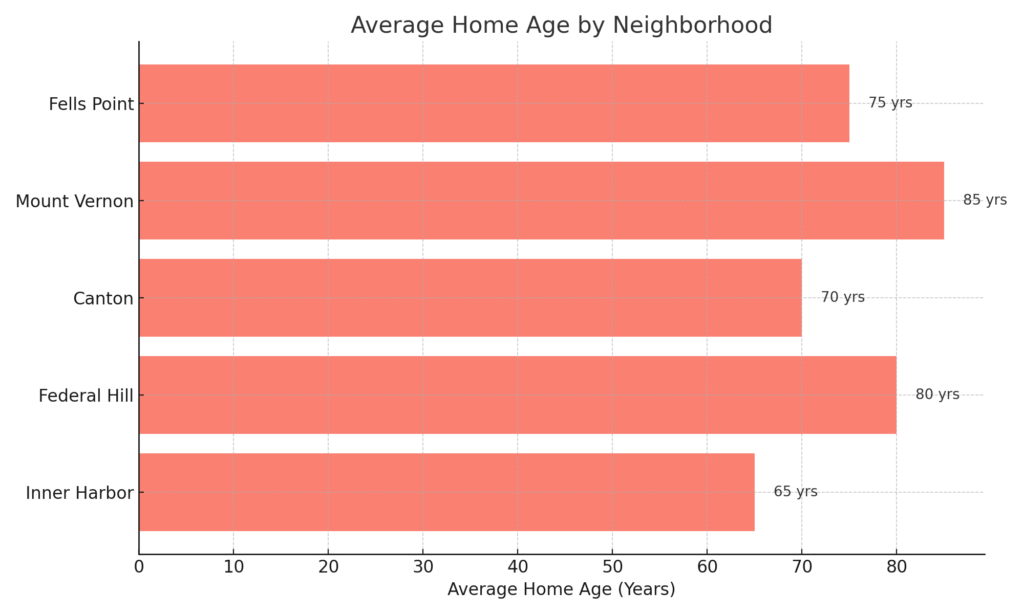

Baltimore’s Inner Harbor (ZIP 21202) lies at the heart of downtown, famed for its picturesque waterfront and bustling commercial areas. Surrounded by iconic landmarks such as the National Aquarium, Maryland Science Center, and historic ships like the USS Constellation, the neighborhood uniquely blends history with modern amenities. The Inner Harbor is densely populated with a mix of residential condominiums, luxury apartments, and historic homes, some dating back to the early 1900s. Due to this mix, residents face varied insurance-related issues: older buildings may incur homeowner’s insurance claims related to structural integrity, plumbing, and electrical systems, while newer structures frequently deal with claims associated with flooding or storm damage given their proximity to the waterfront. Additionally, businesses and homeowners alike contend with insurance complications arising from the neighborhood’s popularity as a tourist destination—such as property damage or liability issues. Residents needing assistance with insurance denials can access community legal aid through organizations like Maryland Legal Aid or community resources provided by Baltimore City government.

Why Was My Inner Harbor Homeowners Insurance Claim Denied?

Common Reasons for Inner Harbor Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers often deny claims by citing exclusions in the policy, such as flood, freezing, earthquake, or mold damage. However, these denials can sometimes be challenged depending on policy wording and state law. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

- Lack of Proper Maintenance: Insurance companies may argue that damage resulted from homeowner neglect rather than a covered peril, placing the financial burden on you. Insurance policies issued in Baltimore typically do not cover “wear and tear.”

- Late or Incomplete Filing: Failing to notify the insurer promptly or not providing the required documentation can be used as a reason for denial. Every successful challenge to a denied claim necessarily includes the insured person cooperating fully with their insurance company. Duty to Cooperate. EUO.

- Disputed Cause of Loss: Insurance adjusters may claim that the damage was caused by a non-covered event, even if the evidence suggests otherwise. This bewilders homeowners, frustrates Baltimore’s homeowners, and often has to be litigated in Baltimore’s courtrooms.

- Misrepresentation or Fraud Accusations: If an insurer suspects inaccurate information was provided—whether intentional or not—they may use it as grounds to deny a claim. I do not handle fraudulent claims. If you have been unfairly or unjustly accused of fraud, I will help you.

If your claim has been denied for any of these reasons, or any other reason, it is critical to have an experienced Baltimore insurance claim attorney review your case. Insurers often rely on technicalities to avoid paying rightful claims. A strong legal advocate can challenge their tactics.

Homeownership in Baltimore’s Inner Harbor Neighborhood

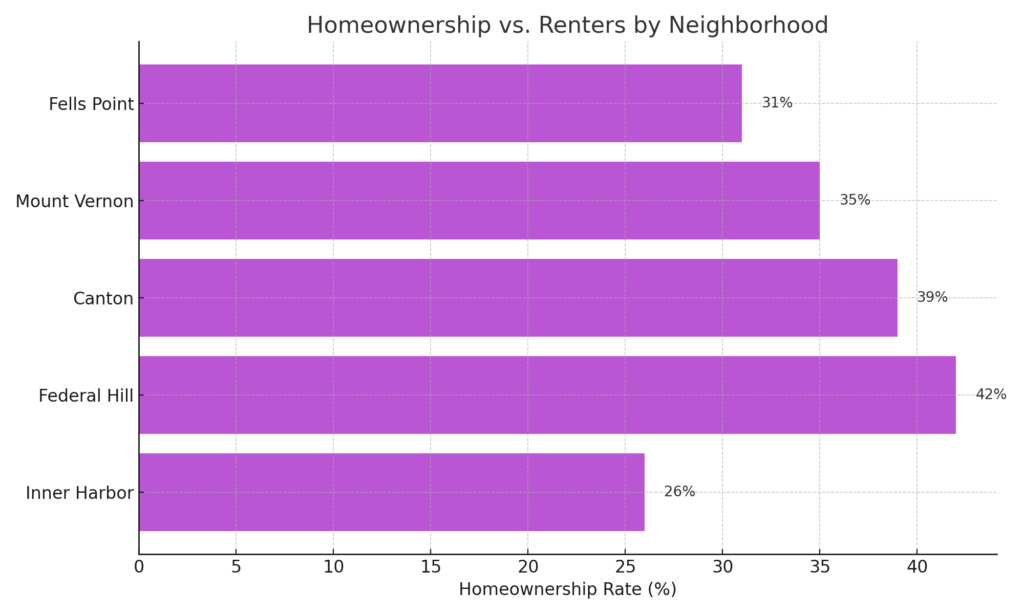

Baltimore’s Inner Harbor boasts diverse housing options ranging from luxury waterfront condominiums to renovated historic townhomes, making homeownership uniquely appealing yet complex. As a Denied Insurance Claim Lawyer serving Baltimore’s Inner Harbor, and 21202 I’ve noted the median home age, around 50 years, means residents may frequently deal with maintenance-related insurance claims. Wear and tear claims are frequently denied. High-density living and waterfront proximity pose additional risks, including potential flooding. Inner Harbor residents enjoy immediate access to vibrant commercial areas, cultural attractions, and entertainment venues, which add both value and potential complications to insurance policies.

Inner Harbor Resources

- Maryland Legal Aid

- Baltimore City Government

- Downtown Partnership of Baltimore

- Inner Harbor Community Association

- Visit Baltimore

Next Steps After an Inner Harbor Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

1. Stabilize and Preserve the Scene of the Loss

- If your home has been damaged, take immediate action to prevent further harm.

- Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example—known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies—is covering a leaking roof with a giant blue tarp.

- Take photos and videos to document the damage as soon as possible.

2. Mitigate Further Loss

- Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

- This could include shutting off water in the event of a plumbing failure or securing broken windows.

3. Notify Your Insurance Company Immediately

- Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots and independent records.

4. Comply with Policy Conditions & Your Duty to Cooperate

- Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

- Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever.

5. Keep Your Denial Communications

- Your insurance company is required to give a written reason for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in—but the clock starts ticking. Statute of limitations.

- Keep all correspondence, including emails and letters, in a dedicated file.

The denial of your insurance claim is a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

6. Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. As a Denied Insurance Claim Lawyer serving Baltimore’s Inner Harbor, and 21202, I often pose this existential question:

What do you do when your insurance company is in denial?

An experienced Baltimore insurance claims attorney will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on your behalf to overturn an unfair denial.

Your Chosen Insurance Chose Not to Pay You. Choose Me.

How Attorney Eric T. Kirk Can Help with Your Denied Inner Harbor Homeowners Insurance Claim

Eric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Inner Harbor denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not—

✔ File a lawsuit. I sue insurance companies.

✔ Take your case to trial. I try cases against insurance companies. I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.