Denied Insurance Claim Lawyer | Baltimore’s Federal Hill | 21230

Your Federal Hill home could be one of your most significant investments—do not allow a denied insurance claim to undermine that value. You’ve faithfully paid your premiums with the expectation of protection, yet when a calamity occurs, your insurer refuses to compensate you? Maddening? I’m Eric T. Kirk, a Baltimore-based Denied Insurance Claim Lawyer, and I make it my mission to oppose unjust claim denials. I file lawsuits against uncooperative insurance carriers, helping Federal Hill homeowners secure the coverage they worked for—and deserve.

Baltimore’s Federal Hill Neighborhood | 21230

Where is the neighborhood in Baltimore, Maryland?

Located just south of the city’s bustling Downtown, Federal Hill in Baltimore, Maryland, sits near the Inner Harbor, bordered primarily by Key Highway, South Baltimore, and the waterfront’s scenic vantage points. Its iconic hilltop park overlooks the harbor, offering panoramic views of the city skyline. The neighborhood’s convenient proximity to major routes—such as I-395—places it only a few minutes from both Camden Yards and M&T Bank Stadium, making it a prime area for sports fans and commuters alike. Federal Hill’s mixture of historic rowhouses and modern residential renovations creates a unique city-living appeal that remains popular among professionals and families.

What is notable about this neighborhood in Baltimore, Maryland?

Federal Hill is known for its vibrant dining and nightlife scene, highlighted by charming pubs, craft breweries, and specialty restaurants tucked along Cross Street, Light Street, and Charles Street. One of its standout features is Federal Hill Park, a historic public space that served as a defensive stronghold during the Civil War era and now provides one of the most picturesque overlooks in the city. The neighborhood also boasts a lively cultural tapestry, with galleries, boutique shops, and community festivals—like the Federal Hill Jazz & Blues Festival—bringing the community together. Residents frequently mention the neighborhood’s “Main Street” atmosphere, anchored by Cross Street Market, a beloved indoor marketplace dating back to the 19th century. Distinctive Federal Hill rowhomes, often adorned with rooftop decks, echo the architectural heritage of Baltimore while embracing modern living. The area is also near major employers, such as the downtown financial district and the city’s growing tech corridor, offering a seamless live-work-play environment. With easy harbor access for kayaking and boating activities, Federal Hill appeals to those who appreciate city life balanced with recreational waterfront opportunities. Its storied past, tight-knit community, and dynamic present-day offerings make Federal Hill truly stand apart within Baltimore.

Why Was My Federal Hill Homeowners Insurance Claim Denied?

Insurance companies can (and do) deny claims for numerous reasons—some with legitimate basis, others motivated by questionable objectives. As a denied Insurance Claim Lawyer for Baltimore’s Federal Hill, I suggest specific local factors such as waterfront weather events, property-related incidents, and community crime rates can impact the claim process. It is often said that the justifications for insurance denials may be limited only by the creativity of the adjuster. Recognizing common denial causes is a key first step in determining how to proceed.

Common Reasons for Federal Hill Homeowners Insurance Claim Denials

- Policy Exclusions: Insurers frequently invoke exclusions like flood, freezing, earthquake, or mold damage. In some instances, these denials can be contested, depending on the policy language and Maryland statutes.

- Lack of Proper Maintenance: Companies may shift blame to homeowner neglect rather than a covered peril, leaving you responsible. Policies issued in Baltimore traditionally exclude normal wear and tear.

- Late or Incomplete Filing: Failing to notify your insurer in a timely manner or omitting key documentation can be used against you.

- Disputed Cause of Loss: An insurer may claim your damages stem from a non-covered event, even if available evidence suggests otherwise. This frequently bewilders homeowners and can ultimately lead to courtroom battles in Baltimore.

- Misrepresentation or Fraud Accusations: If you are accused—fairly or otherwise—of providing inaccurate details, your claim may be quickly denied. If those accusations are unjust, I can help you fight back.

When an insurance carrier denies your claim, securing a reputable Insurance Coverage Denial Lawyer is essential. A lawyer’s review can identify gaps in the insurer’s argument and challenge unfair denials.

Homeownership in Baltimore’s Federal Hill Neighborhood

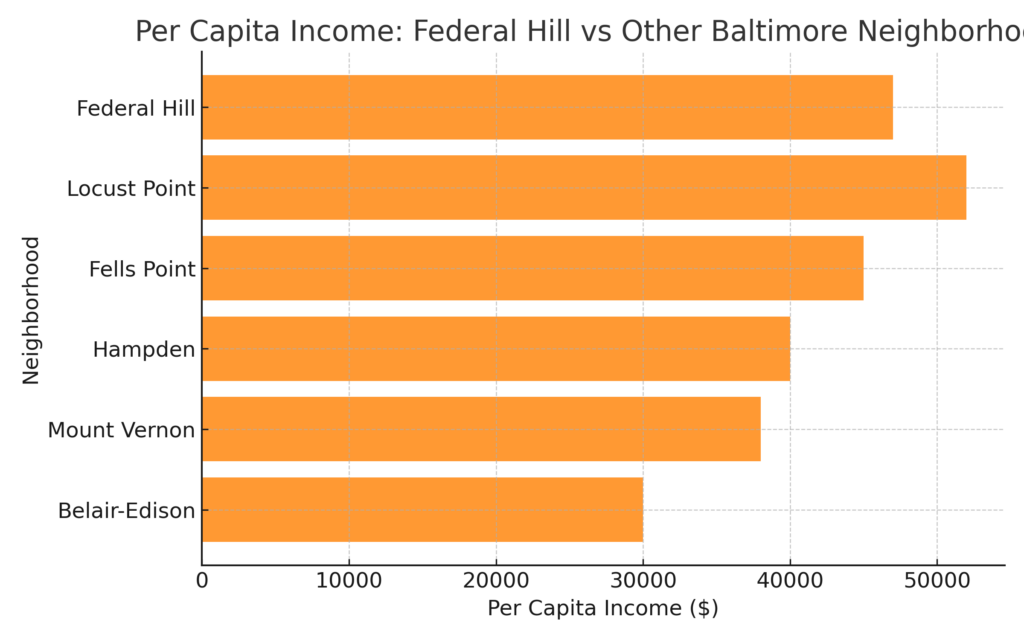

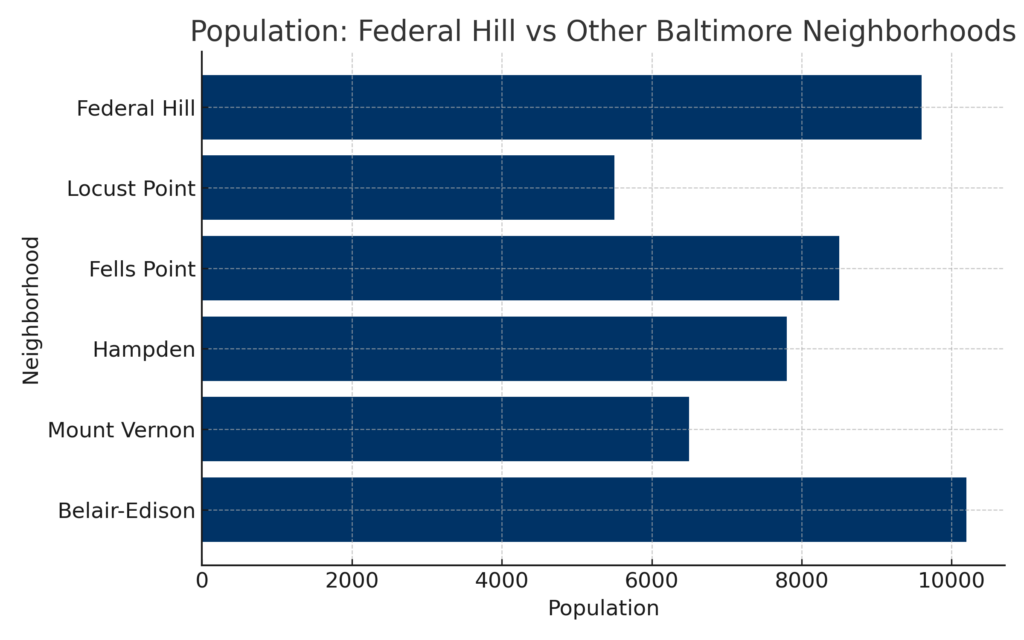

According to publicly available data from Baltimore City and federal sources, Federal Hill exhibits a robust housing market that skews toward renovated rowhomes, many originally built in the 19th century. As of the most recent figures, the median home value hovers around $380,000, while sales prices can vary based on proximity to the waterfront or historical status. Homes often spend roughly 40 days on the market—longer if they are higher-end or have extensive updates. About 60% of listings ultimately sell below initial asking price, indicating room for negotiation in this moderately competitive market. Urban charm, convenience, and strong community involvement have continued to make Federal Hill a desirable choice for many Baltimore residents.

Next Steps After a Federal Hill Homeowners Insurance Claim Denial

A denied claim is not the end of your road. Taking the, next, right and vital steps immediately after denial can help preserve your rights and strengthen your case.

- Stabilize and Preserve the Scene of the Loss

• If your home has been damaged, take immediate action to prevent further harm.

• Avoid making permanent repairs before your claim is fully evaluated, but you must take steps to prevent worsening conditions. The classic example,- known to Floridians who have had their hurricane damage claims denied by the nation’s largest insurance companies- as covering a leaking roof with a giant blue tarp).

• Take photos and videos to document the damage as soon as possible. - Mitigate Further Loss

• Baltimore’s homeowner’s policies likely include a duty to mitigate loss, meaning you must take reasonable steps to prevent additional damage. Even if it does not contain that clause, substantive law requires the homeowner to employ measures to stop additional loss or damage. This is the Duty to Mitigate.

• This could include shutting off water in the event of a plumbing failure or securing broken windows. - Notify Your Insurance Company Immediately

• Contact your insurance company to formally report the loss. Do this in writing whenever possible to create a record of your communication. Use a portal if one is available, but retain screenshots, and independent records.

• State Farm

• Traveler’s

• Allstate

• Nationwide

• USAA - Comply with Policy Conditions & Your Duty to Cooperate

• Insurance policies often have strict duties after a loss, such as providing a sworn proof of loss, giving recorded statements, or attending an examination under oath.

• Failing to comply can give your insurer additional grounds to deny your claim. The courts in Baltimore have found that a homeowner’s refusal to adhere to these contract obligations can bar the insurance claim forever. - Keep Your Denial Communications

• Your insurance company is required to give a written for your claim denial. Retain this document, with all others. Once your claim is denied, your legal rights are locked in, but, the clock starts ticking. Statute of limitations. Keep all correspondence, including emails and letters, in a dedicated file.

The Denial of your insurance claim in a vital juncture in the process of you being made whole for your loss. It is when your claim has been denied, in whole or in part, that I can likely be of the most assistance.

- Seek Legal Guidance from an Experienced Baltimore Insurance Claims Denial Attorney

• Do not accept the denial at face value—Not all insurance claim denials are misplaced. Insurance companies sometimes deny valid claims for reasons that may be challenged in court. Breach of Contract. I am A Denied Insurance Claim Lawyer, Baltimore’s Federal Hill | 21230. I will review your policy, analyze the insurer’s reasoning as contained in their denial letter, and litigate on our behalf to overturn an unfair denial.

How Attorney Eric T. Kirk Can Help with Your Denied Federal Hill Homeowners Insurance Claim?

Eric T. Kirk

Federal Hill Insurance Claim Denial LawyerEric T. Kirk has spent a career holding insurance companies accountable for wrongfully denied claims. When you hire our firm, we will:

✔ Complimentary Case Analysis – Fight Back Against Unfair Denials

✔ Analyze your policy and determine whether the insurer’s denial is valid. Every successful challenge to a denied claim starts with an analysis of the insuring agreement.

✔ Gather your evidence to support your claim. Most Federal Hill denied insurance claims require expert analysis on the cause of loss and nature of damage.

✔ Negotiate aggressively and consistently with your insurer, seeking to engineer a fair settlement. If not

✔ File a lawsuit I sue insurance companies

✔ Take your case to trial. I try cases against insurance companies. I can tell you the nation’s largest insurance companies hire very skilled, very talented, very aggressive lawyers to take their cases to trial.